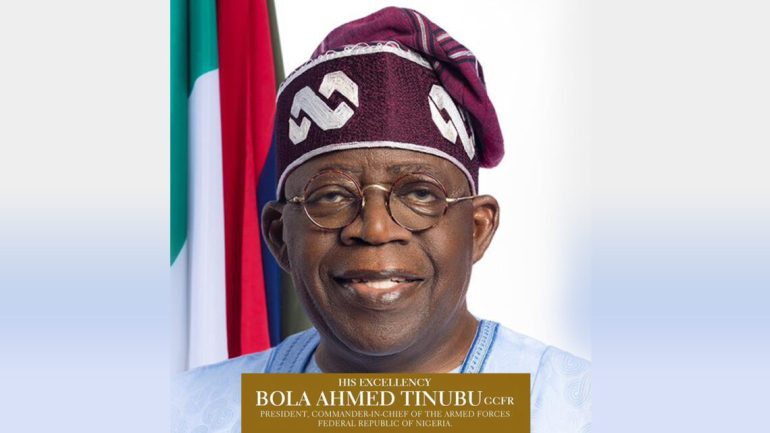

Hon. Abike Dabiri-Erewa, Chairman/CEO, Nigerians in Diaspora Commission (NIDCOM) has commended the new payout policy ofthe Central Bank of Nigeria (CBN) as a boost to diaspora remittances describing it as a further encouragement for Diaspora Remittances by the new administration of President Bola Ahmed Tinubu.

In a statement by Abdur-Rahman Balogun, Head of Media and PublicRelations of the Commission, Dabiri-Erewa said the approved Nairapayouts would equally motivate Nigerians in the Diaspora to send more money back home for developmental projects as against consumables.

The NIDCOM boss noted that with the new CBN policy, people can get openmarket rates, instead of just official rates when they send money through the bank from abroad.

Nigeria’s Central Bank has approved Naira payout for diaspora remittance, ending a ban that had been in place since December 2020.

In a circular dated July 10, 2023, Nigeria’s Central Bank approved the payment of the Naira to beneficiaries of diaspora remittance.

The circular means that banks and International Money Transfer Operators (IMTOs) can now pay their recipients in Naira, ending a 3-year ban.

In December 2020, the CBN banned banks and IMTOs from paying recipients in Naira.

The policy also stated that only banks could transfer funds onward to recipients.

In theory, the CBN policy ended the business model of many digital remittance companies that allowed Nigerians abroad to send money directly to the Naira accounts of recipients.

Months after the “Naira payment ban,” the CBN introduced the Naira for Dollar Scheme in March 2021. These policies were part of GodwinEmefiele’s attempts to encourage diaspora remittances to move through formal channels and boost Foreign Exhange liquidity.

The bank hoped to squeeze unlicensed IMTOs out of business by insistingon paying recipients foreign currency.

This recent policy removal is another step towards loosening the strictcontrol the CBN has exercised over Foreign Exchange rates in the last five years. It’s also great for customers who can now choose between receivingtheir funds in foreign currency, eNaira and the Naira.

Customers who choose to receive their funds in Naira will be paid using the Investors& Exporters Window rate on the day of the transaction.

According to World bank reports, Nigerian Diaspora community remitted$168.33 billion to the country in the past eight years between 2015 to2022.