June 26, 2025

By Adedoja Adesoji

President Tinubu has given executive approval to the Tax Reform Bills, ushering in significant changes to Nigeria’s tax landscape.

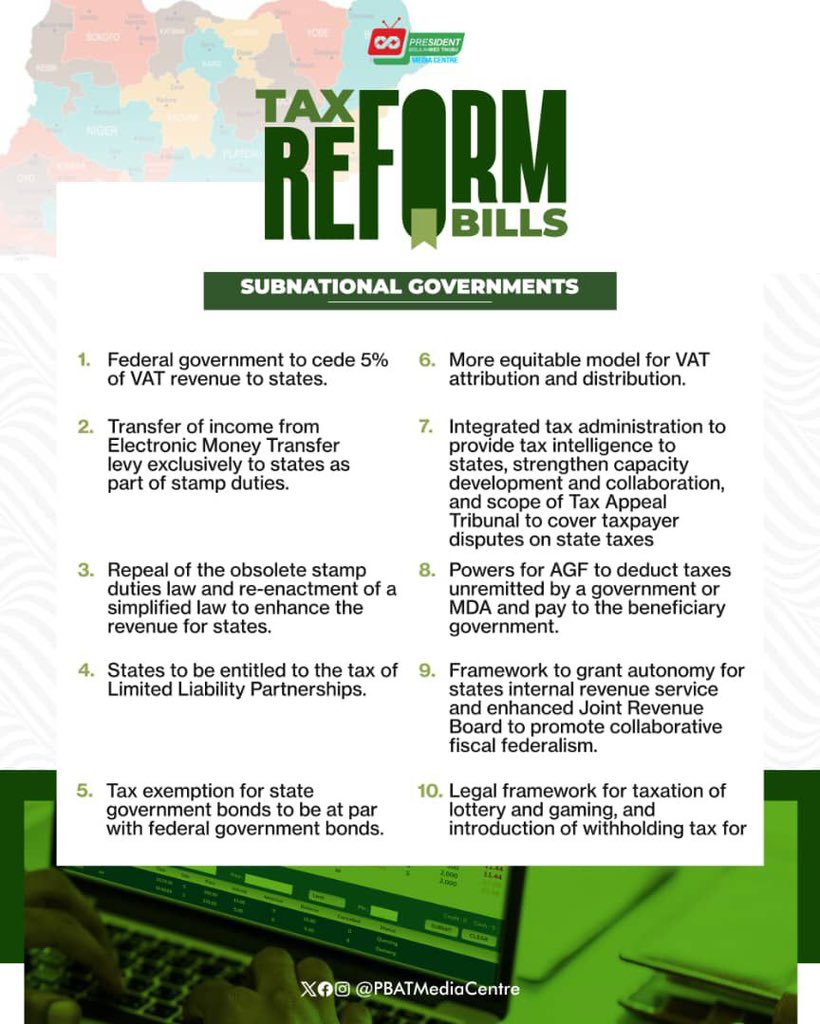

The Federal Inland Revenue Service (FIRS) will undergo a rebranding to become the Nigeria Revenue Service (NRS).

This transformation will grant NRS the authority to collect revenues previously managed by other agencies, including the Nigeria Customs Service, NUPRC, NPA, and NIMASA.

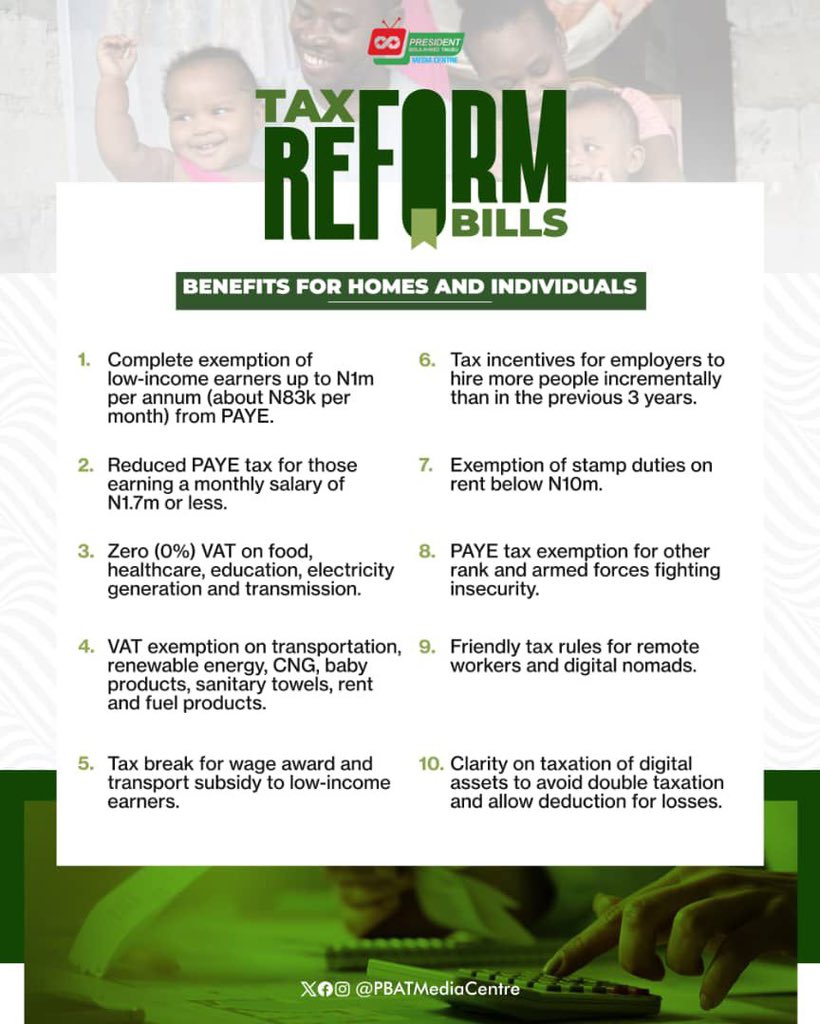

Individuals earning an annual income of ₦800,000 or less will be exempt from paying taxes. A 25% personal income tax rate will only apply to high-net-worth individuals with annual incomes exceeding ₦50 million.

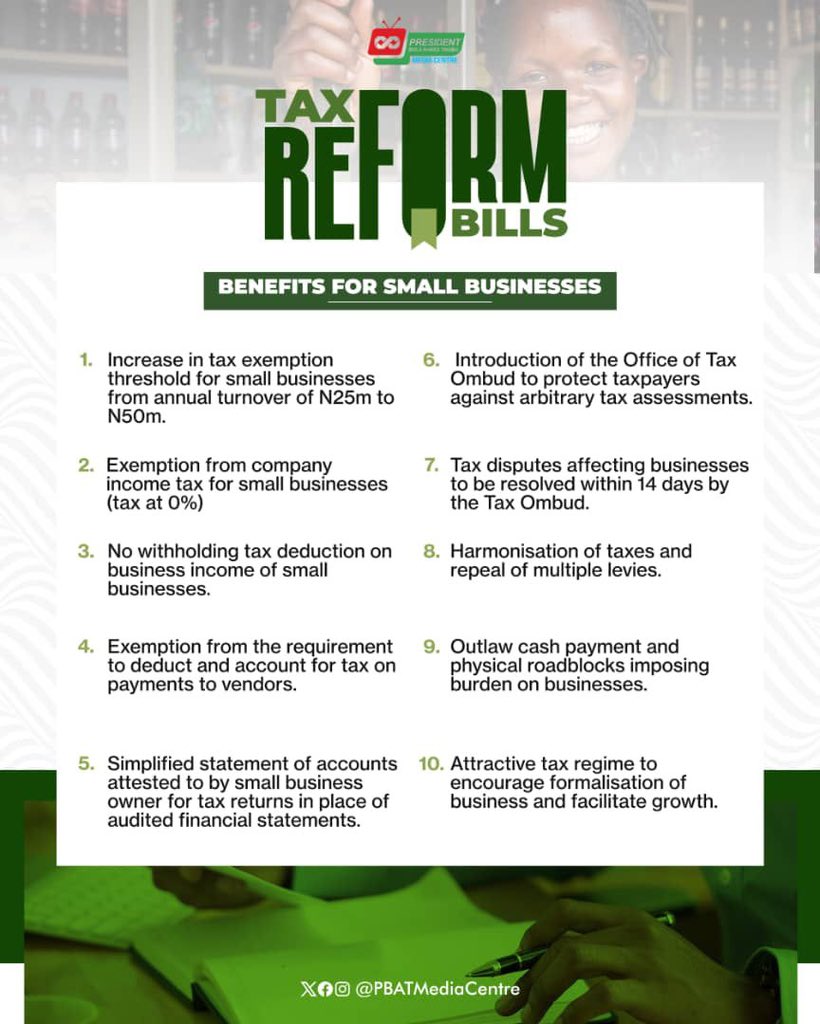

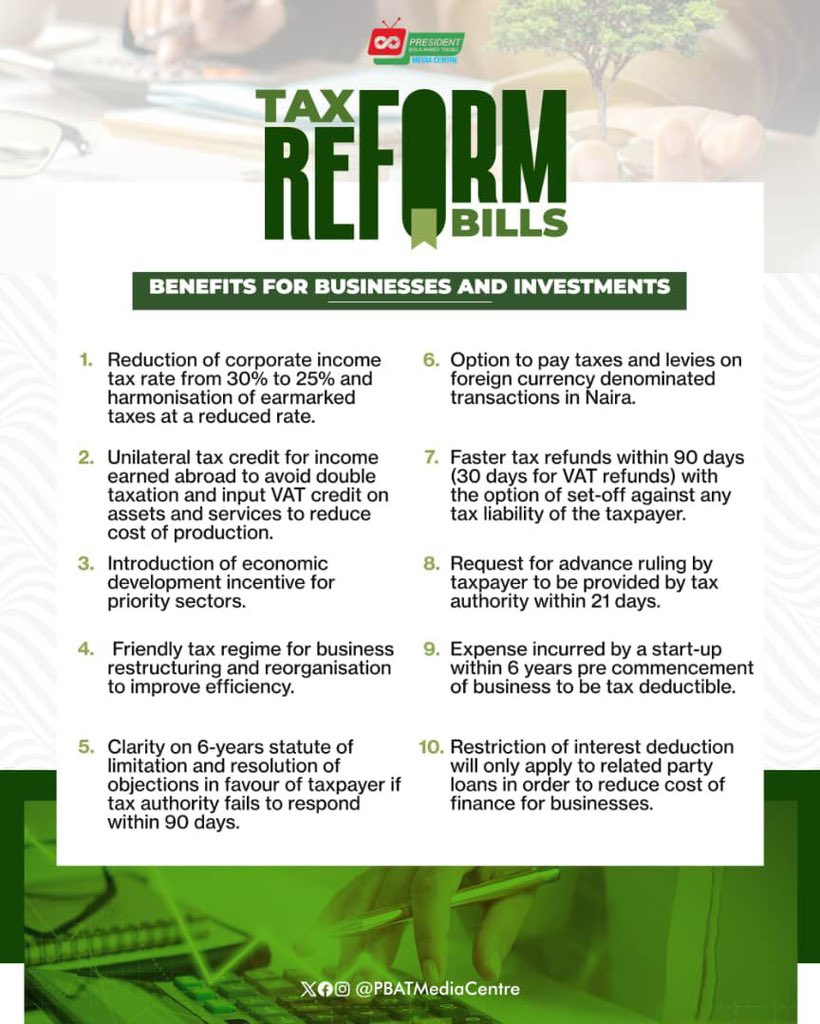

Small business owners will breathe a sigh of relief as they are now exempt from paying income tax. Medium and large companies can also expect a reduction in company income tax from 30% to 25%, effective 2026.

The Value Added Tax (VAT) rate remains unchanged at 7.5%. However, essential goods and services consumed by the poor, such as food items, medical services, pharmaceuticals, educational fees, and electricity, will be exempt from VAT.

A new Development Levy, ranging from 2% to 4%, will be introduced to support key national institutions, including NELFUND, TETFund, NITDA, and NASENI. This levy aims to drive development and growth in critical sectors.