May 6, 2024

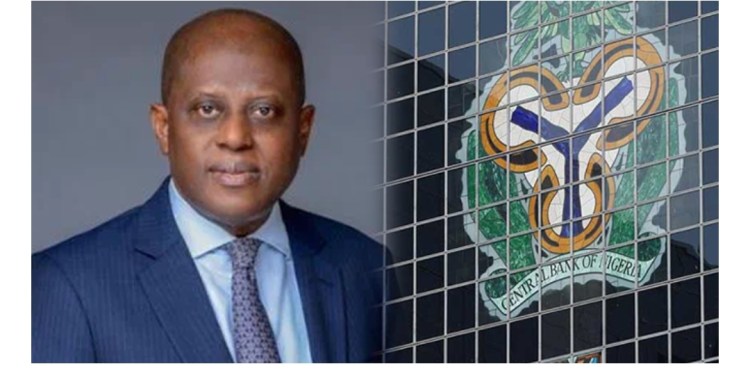

Four top Fintech firms – Opay, Kuda, Monie Point, and Palmpay – are working very hard to prevent imminent Central Bank of Nigeria (CBN) sanctions on operators that facilitate crypto-currency transactions.

The Fintechs recently received instructions from the Office of the National Security Adviser (NSA) to cease onboarding new customer accounts by opening new accounts.

Industry sources said the directive was a prelude to the CBN’s plan to outlaw peer-to-peer cryptocurrency trading.

Depending on when the CBN’s hammer falls on operators, Kucoin, Bybte, and the rest of the crypto currency exchange will be banned from enabling crypto traders in Nigeria to buy or sell USDT.

Analysts explained that as a prelude to the official announcement coming soon, fintech apps Moniepoint, Paga, and Palmpay have blocked and are blocking the accounts of customers dealing in cryptocurrency and reported those transactions to law enforcement after the NSA classified crypto trading as national security.

In a message to its customers seen by The Nation, PalmPay management updated clients about an important development in the use of PalmPay accounts and other fintech accounts.

”In line with the recent directive from the Central Bank of Nigeria (CBN), we would like to emphasise that engaging in crypto-related transactions, including cryptocurrency trading, using PalmPay accounts is strictly prohibited. Furthermore, Participating in gambling platforms and any other illegal activities is also not permitted,” the Fintech firm said.

Continuing, PalmPay said: “It’s important to adhere to these regulations to ensure compliance with CBN guidelines and to avoid any disruptions to your account. Any accounts found involved in such activities will be subject to immediate action, which may include account blocking or other measures as outlined by the CBN.

”If you have any questions or require further clarification regarding this matter, please feel free to reach out to us. Thank you for your attention and cooperation in maintaining compliance with these important guidelines.”