September 24, 2025

By Ayinde Adeleke

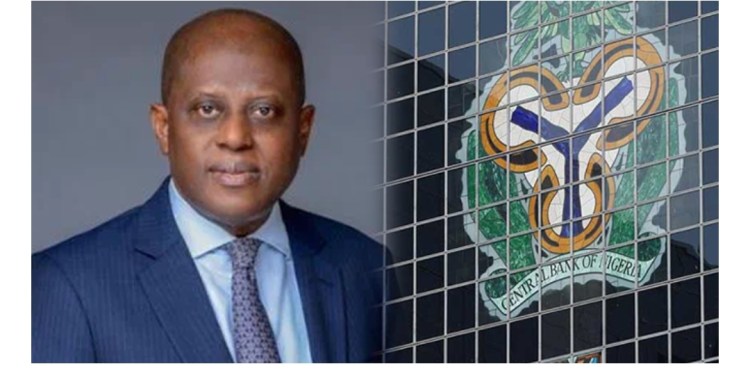

Nigeria’s external reserves have risen to $43.05 billion, providing an import cover of about 8.28 months, the Central Bank of Nigeria (CBN) has announced. The figure, recorded as of September 11, 2025, reflects an increase from $40.51 billion at the end of July 2025.

The apex bank also disclosed that 14 banks have fully met the new minimum capital requirements introduced under its ongoing banking sector recapitalisation programme. The requirements vary across license categories, including international, national, regional, and non-interest banks.

At the end of its latest Monetary Policy Committee (MPC) meeting, the CBN announced several policy adjustments aimed at strengthening the financial system and supporting economic stability. The Monetary Policy Rate (MPR) was reduced by 50 basis points from 27.50 percent to 27 percent, while the Cash Reserve Ratio (CRR) for commercial banks was lowered to 45 percent from 50 percent. The CRR for merchant banks remains at 16 percent, while a 75 percent CRR was introduced on non-TSA public sector deposits.

The MPC also adjusted the standing facilities corridor to ±250 basis points around the MPR and retained the Liquidity Ratio at 30 percent.

In addition, the CBN reported a current account surplus of $5.28 billion in the second quarter of 2025, compared to $2.85 billion in the first quarter. The apex bank further announced the end of forbearance measures and waivers on single obligor limits, as part of efforts to strengthen risk management, transparency, and resilience in the banking sector.

The CBN said the combination of improved external reserves, stronger capitalisation of banks, and monetary policy adjustments is expected to enhance financial stability and boost investor confidence in the Nigerian economy.