December 30, 2024

By Ayinde Adeleke

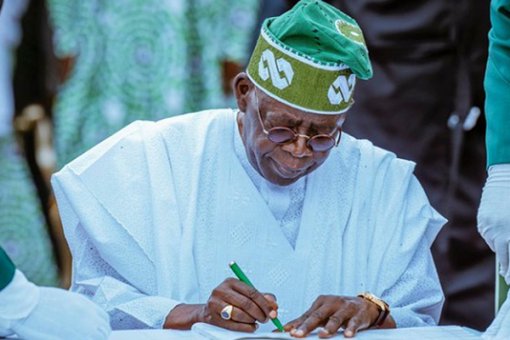

The Presidency has responded to Governor Bala Mohammed of Bauchi State’s threat to President Bola Tinubu’s administration over the government’s insistence on the passage and implementation of the controversial tax reform policy.

In a statement issued on Monday by the Special Adviser to President Tinubu on Media and Public Communication, Sunday Dare, the Presidency expressed surprise that despite receiving N144 billion federal allocation under Tinubu’s administration, Bauchi State still grapples with high poverty rates under Governor Mohammed.

“The recent inflammatory rhetoric of Governor Bala Mohammed regarding the Tax Reform Act and direct threats toward the Federal Government are unbecoming of his office as a state governor,” Dare said.

“His statement: ‘We will show President Tinubu our true color’ is particularly concerning and does not reflect the constructive dialogue needed between state and FG.”

Dare emphasized that Bauchi State has received a significant increase in federal allocations under the current administration, yet the state continues to face developmental challenges and high poverty rates.

“Rather than issuing threats, his energy might be better directed toward implementing effective poverty alleviation programs and ensuring transparent utilization of these federal resources,” Dare suggested.

“This unfortunate statement does not represent the collective voice of Northern Nigeria. The North, like other regions, seeks collaborative governance and constructive engagement with the Federal Government to address our nation’s challenges.”

Governor Mohammed had described President Tinubu’s tax policies as anti-northern Nigerian, threatening that the region would show Tinubu’s government its true colors.

He alleged that the Tax Reforms Bills favor just a section of the country and shortchange northern Nigeria.

Dare urged Governor Mohammed to retract his confrontational remarks and redirect his focus toward productive dialogue with the federal government regarding any concerns about the Tax Reform Act.

“The Tax Reform Act and increased federal allocations offer significant benefits to the States,” Dare said, highlighting the benefits of the tax reform policy.

These benefits include streamlining multiple taxation systems, enhanced revenue collection efficiency through digitalization, protection of informal sector workers, and special provisions for agricultural businesses.

The Presidency also emphasized the federal government’s commitment to supporting state development through initiatives such as frameworks for attracting investments, capacity building for state revenue services, and special consideration for derivation funds protecting northern states’ interests.