The Central Bank of Nigeria(CBN) has said it expects a massive inflow of Foreign Direct Investment (FDIs) with foreign investors taking position in Nigerian banks through the on-going recapitalisation exercise.

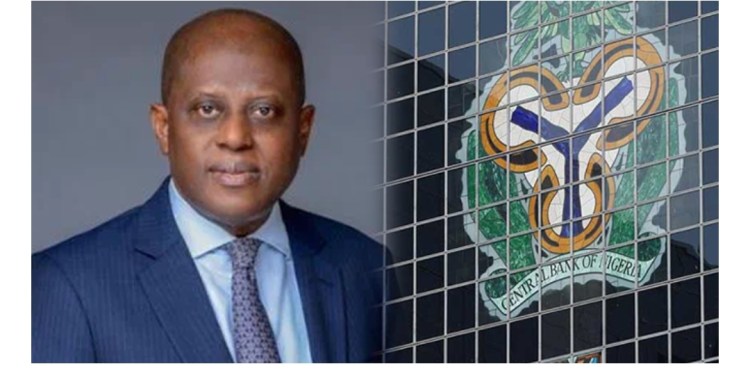

Director, of Financial Policy and Regulation Department (FRPD) CBN, Haruna Mustafa, stated this in an interview stressing that the banking recapitalisation exercise held enormous opportunities for the economy, especially in terms of enhancing forex market reforms.

He said: “This policy holds enormous promise and opportunities not only for the banking system but for the wider economy we expect to see a massive inflow of foreign direct investment and these are patient funds that any economy will need for long-term sustainable growth.

“Because one fundamental challenge for our development story is the absence of long-term patient capital. This is going to lead to an inflow of foreign direct Investments, FDI. We expect we’re looking to see investors coming in to take a position in our banking system.

“If to the extent that we have more forex inflows to that extent, we are going to have a salutary impact on liquidity in the FX market and which will also have a concomitant positive impact on the exchange rate.

“It’s just simple demand and supply very true and this is because this will be complimentary to ongoing reforms by the CBN to ensure that we achieve stability and credibility in the FX market.”

Exclusion of retained earnings

Addressing concerns over the exclusion of retained earnings from the composition of banks’ minimum paid-up capital, Mustafa said the decision was to nudge banks to inject fresh capital, adding that this was in line with the two broad objectives of the recapitalisation exercise.

He said: “Under the policy, we set out two broad objectives. Number one is to enhance insolvency and resilience in banks to enable them absorb current and unexpected shocks and this is speaking to the traditional function of capital which is to absorb unexpected losses and this is very very important because capital is very core. It is one of the key metrics that regulators and supervisors use in assessing the soundness of banks.

“The second objective is to reposition the bank to continue to support the development and growth of the Nigerian Economy and this is in the concept of the current administration to achieve a $1 trillion economy by the year 2030.

“Banks play a very critical and pivotal role in this regard. So these are the two broad objectives and under the policy banks are expected to achieve the minimum requirement through multiple pathways.

“The overarching objective is to strengthen the bank. Now banks are expected to meet these requirements in terms of the definition of this capital is supposed to comprise paid-up capital and shared premiums. I am sure a lot of people will be seeing, be wondering why the CBN excluded other reserves, especially retained earnings. But suffice it to say that what we are doing is the ordinary discharge.

“What we have simply done is to nudge the banks to inject capital. And this is without prejudice to what the different components of shareholders’ funds will be.

“And like we have stated in our circular, shareholders funds, and other reserves will continue to be recognized in the computation and determination of banks’ capital adequacy ratio, which is an important metric in our assessment of the soundness of banks.

“So it doesn’t detract from what the capital adequacy of banks should be and we are not changing the definition of capital.”

Speaking on how the policy will enhance banks’ ability to support the economy, Mustafa said: “This policy is like a silver bullet that will help in achieving multiple objectives and so that is the end goal and at the end of the day we see banks being able to support the growth of the economy.

“And just to put this in bold relief and I’m very sure the banks will also relate to this, capital is critical not only like mentioned in terms of their ability to be able to absorb shocks but even in terms of the ability to be able to operate.

“In supervisory parlance, we have some metrics that we use in restricting or limiting bands risk exposures.

“For example there is what we call Single Obligor Limit, which is a function of capital. So banks cannot lend to a single borrower in excess of 20% of their shareholders’ funds unimpaired by losses.

“Now what that means to put it in layman’s language, is if I wanted to lend to a promising customer like, quote and unquote, one of the oil majors for instance I’m hamstrung if my capital is not sufficient to meet his needs and that does not do well for the sustainability of the banking system.

“So that is one of the things we are trying to achieve. If banks cannot lend, especially take advantage of profitable opportunities then it becomes an issue in terms of their long-term growth and sustainability and that could have a Knock-on effect on their bottom line, which will also have a knock-on effect on their Capital.

“Talking about contribution to GDP, I mentioned the pivotal rule that banks play in any economy. Now for them to be able to effectively play that role they need to be robustly capitalized to be able to support the growth of the economy to the extent that banks are able to effectively perform their intermediation function. It is to that extent are they able to contribute to economic growth.

“Think about the different economic players that will access credit for instance, the multiple benefits that will accrue to manufacturers, other economic players and also the job opportunities that will be created up and down the value chain.”