Nigeria’s commercial banking, fintech, and telecommunications sectors have maintained excellent media interactions, marketing, and awareness since the start of 2024 despite the weakening of the Naira against the Dollar and its effect on businesses across the country.

These were further enhanced by the remarkable data it gave the media in the first quarter of the year.

This media analysis monitors more than 1.3 million online publications from blogs, news sites, broadcasts, forums, and digital media in the local and global media space, as well as about 5,115 print publications (including daily, weekly, and monthly publications), from which different metadata are extracted, including the sentiment of reporters, editors, publishers, and opinion writers from various online and print publications, spokesperson analysis, CEOs performances, and other topics.

In the first quarter of 2024, P+ Measurement Services, Nigeria’s leading media intelligence consultancy, examined the media mood around commercial banks, fintech Companies, and telecommunications providers in Nigeria.

This analysis shows editors’, publishers, journalists, and opinion leaders’ perceptions of fintech, commercial banking, and telecommunication brands in the print and online media.

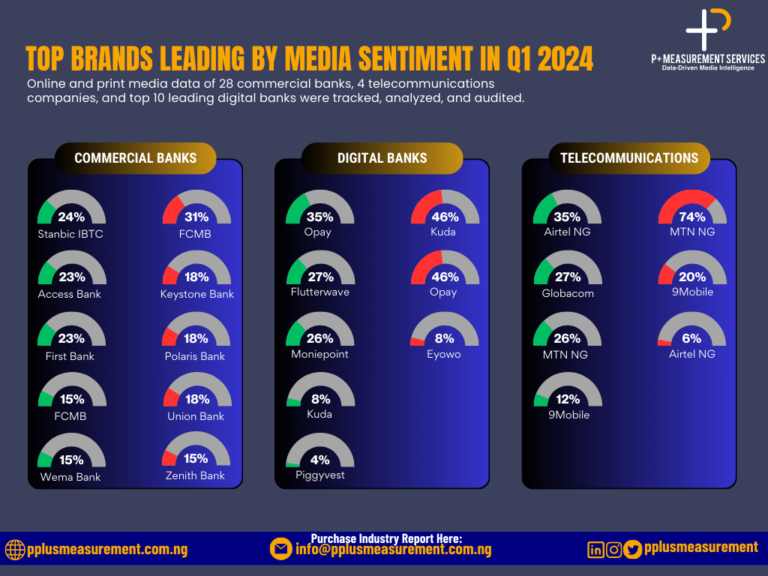

A thorough review of the commercial banks’ media reputation shows that two tier-1 banks and three tier-2 banks made the top five with the highest positive feelings in Q1 2024, while one tier-1 bank, and four tier-2 banks made the list with the highest negative attitudes.

The top five banks by positive reputation include Stanbic IBTC Bank with 24 percent emerging at the top of the grid, closely followed by First Bank and Access Bank with 23 percent, with First City Monument Bank (FCMB) and Wema Bank both having 15 percent.

The top five banks with negative media reputations are First City Monument Bank (FCMB) with 31 percent, followed by Union Bank, Polaris Bank, Keystone Bank having 18 percent, and Zenith Bank with 15 percent.

Analysis of the fintech companies’ media sentiment revealed that Opay came out on top in the first quarter’s positive reputation survey with a 35 percent rating, followed by Flutterwave with 27 percent, Moniepoint with 26 percent, Kuda with 8 percent, and Piggyvest with 4 percent.

In the first quarter’s negative reputation audit, Kuda and Opay both came out on top with 46 percent and Eyowo with 8 percent.

According to the analysis of the Telecommunication industry in Nigeria in quarter one, Airtel received the highest positive reputation score (35%), followed by Globacom (27%), MTN (26%), and 9mobile (12%) for the first quarter of 2024. MTN received the highest negative reputation score (74%), followed by 9mobile (20%) and Airtel (6%) for the same period.

Positive Reputation Drivers

The analysis below outlines the most important factors contributing to the positive reputation of the leading commercial banks, fintech companies, and telecommunication providers in Nigeria in Q1 2024.

In the banking sector, Stanbic IBTC Bank solidified its leadership status by introducing an Enhanced Super App tailored for business owners.

Meanwhile, Access Bank extended its footprint into Kenya, with aspirations of achieving full ownership of the National Bank of Kenya (NBK).

Additionally, First Bank clinched the prestigious Corporate Bank Award at the 2023 Euromoney Awards, further enhancing its reputation and standing in the industry.

In the fintech sector, OPay, a frontrunner in financial technology in Nigeria, revolutionized its customer service with groundbreaking solutions aimed at elevating user satisfaction and enriching customer experiences.

Meanwhile, Flutterwave took a significant step forward by appointing its inaugural independent, non-executive board member. Moniepoint surpassed a remarkable milestone, processing over 5 billion transactions in 2023, showcasing its substantial impact on digital payments.

Additionally, Kuda Microfinance Bank demonstrated its commitment to customer engagement by hosting a six-hour live customer service session on Valentine’s Day, fostering a deeper connection with its clientele.

Leading the telecommunications sector, Airtel made waves with its announcement of intentions to build a state-of-the-art 34MW data center in Nigeria. Meanwhile, the reliability of Glo1 Cable remained steadfast amidst challenges due to the multiple subsea cable cuts, while MainOne, WACs, and other providers grappled with the looming threat of prolonged outages. Additionally, under the leadership of Karl Toriola, MTN Nigeria experienced a remarkable growth trajectory and underwent a significant digital transformation, positioning itself for continued success in the evolving telecommunications landscape.

Negative Reputation Drivers

An analysis of the negative reputational drivers in the banking sector revealed that FCMB was directed to pay N540 million in damages for defaming preacher Emmanuel Omale.

This was followed by the unprecedented move by the CBN to dismiss the boards of Union, Keystone, and Polaris Banks. Moreover, the managing directors of Zenith and Providus Banks found themselves under scrutiny at the EFCC regarding their alleged involvement in Betta Edu’s fraud case.

Meanwhile, a Kuda Bank customer raised concerns about missing savings in her account. Additionally, following an unsuccessful travel ticket purchase, OPay held onto a customer’s N36,133 for two years. Meanwhile, Moniepoint MFB faced allegations of facilitating fraudsters in stealing a customer’s N9.6 million.

Amidst these developments, Eyowo’s endeavor to establish itself as a fintech powerhouse encountered notable hurdles stemming from the intricacies of transitioning from a software provider to a B2C fintech startup.

In the telecommunications sector, subscribers of MTN, Airtel, and 9mobile voiced their dissatisfaction with subpar internet service and inadequate telephone quality.

About P+ Measurement Services

Leading and rapidly expanding independent media intelligence consultancy, P+ Measurement Services is an AMEC member and one of Nigeria’s top media intelligence providers.

The agency serves as a media watchdog and technical support to communications/public relations managers and public relations firms by assisting them in keeping track of the media health of their brands and auditing media performance.